The 2024 Financial Planning Checklist for Private Clients

As the post-election landscape brings a bit more clarity, uncertainties remain including the looming Tax Cuts and Jobs Act (TCJA) set to sunset in 2025. While the incoming administration has signaled intentions to make these tax provisions permanent, there are still legislative hurdles to overcome. This year’s financial planning checklist highlights key themes to consider in the current market and tax environment:

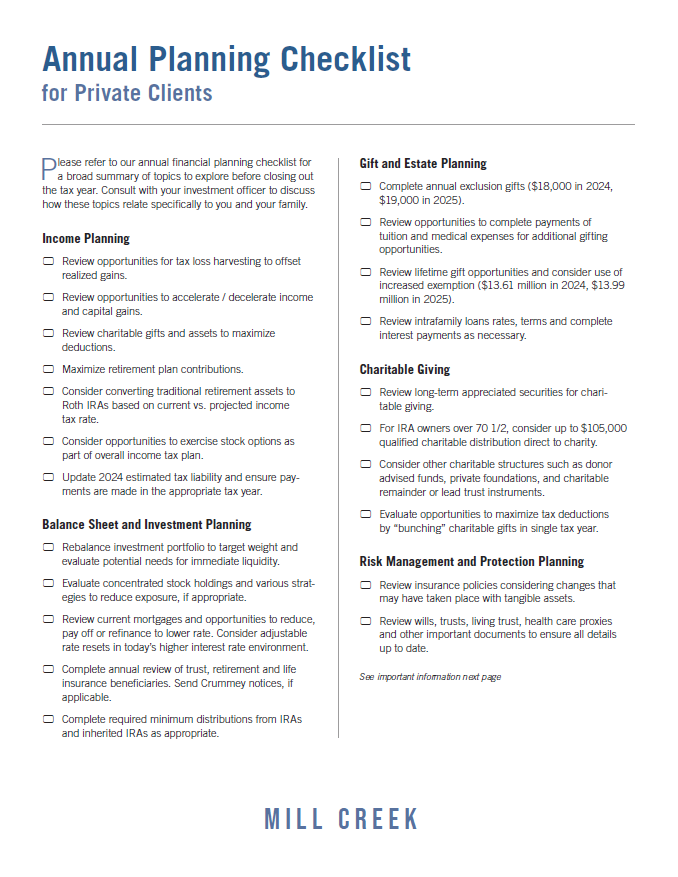

- Estate Planning and Gifting Opportunities: It is an important best practice to assess your family’s evolving estate goals and objectives and revisit wills, trusts, and beneficiary designations. Consider using your lifetime $13.61 million ($27.22 million for married couples) federal estate, gift, and generation-skipping transfer tax exemption to transfer wealth now and minimize potential estate tax liabilities. Additionally, the 2024 annual gift exclusion of $18,000 per individual ($36,000 per married couple) and the ability to make direct payments for education or medical expenses present opportunities to transfer wealth to future generations without using your lifetime exemption.

- Charitable Giving and Tax Efficiency: As we enter year-end giving season, evaluate tax-efficient ways to donate assets to charity. Donating to donor-advised funds can provide a tax deduction in 2024, even if you choose to distribute funds to charities in later years. Donating appreciated assets held for more than one year can provide a fair market value deduction while avoiding capital gains taxes on the appreciation. Qualified charitable distributions from IRAs to charities can also help fulfill required minimum distributions while reducing taxable income.

- Income Tax Strategies: If you may be in a lower income tax bracket now than you expect in the future, you should consider accelerating income into 2024 to lock in current rates. This could include exercising stock options or converting Traditional IRAs to Roth IRAs. Reviewing capital gains and losses to determine if your family members qualify for the 0% or 15% capital gains rate is also a worthwhile exercise. If you are in a higher tax bracket than normal, accelerating deductions can be beneficial, especially if you are in the 32%, 35%, or 37% tax bracket. It’s also essential to review income tax withholding and estimated tax payments to avoid underpayment penalties.

- Retirement Account Maximization and Required Minimum Distributions (RMDs): You should consider maximizing retirement contributions to 401(k)s, IRAs, SEPs, and SIMPLE IRAs. Individuals aged 50 and older should also consider catch-up contributions to supplement their retirement contributions. Make note that under the SECURE 2.0 Act, a new “super” catch-up provision allows individuals aged 60 through 63 to contribute an even greater amount. Perhaps most importantly, ensure you complete 2024 RMDs to avoid penalties and review retirement account beneficiaries for any necessary updates.

- Investment Portfolio Review and Tax-Loss Harvesting: Equity markets recently achieved another all-time high, following several years of strong growth for risk assets. Year-end is an ideal time to evaluate investment portfolios and make necessary adjustments to ensure the investment portfolio’s risk and liquidity profile are in line with your intentions, and take the opportunity to replenish cash and liquid positions to be prepared for what unexpected market events could come. While strong markets minimize the opportunity to harvest losses in equities, evaluating losses in fixed income investments may help to reduce overall tax bills.

Download the 2024 Financial Planning Checklist here.

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.